Why is called snowball?

This is mainly due to the income characteristics of its options. This type of option structure not only provides a certain degree of fall protection, but also expresses a "moderately bullish" view on the market. As long as the price of the underlying asset does not fall sharply, the longer the holding period, the more profitable it will be. This process is like rolling a snowball. As long as there are no big potholes on the road, the snowball will roll bigger and bigger, so it is called "snowball".

What kind of investors are suitable for investing Snowball products?

1、our products are very suitable for investors who are looking for long-term stable returns.

2、It is suitable for investors who expecte that the price of the underlying asset will continue to fluctuate, drop or rise slightly, but it is unlikely to see a large and continuous drop.

3、It is suitable for investors who are clearly aware of the risk-return characteristics of Snowball products, which are "low risk and high return", and have corresponding investment needs.

What are the basic elements of Snowball products?

To understand the Snowball product, you should first understand the following basic concepts:

1、Product Type

At present, various types of snowball products have been derived in the market. According to the degree of potential principal loss, they can be divided into: principal protection type, limited loss type, and non-principal protection type snowball products; according to the product lock-in service, they can be divided into: snowball products with lock-up period and snowball products without lock-up period; according to whether the knock-out price is adjusted gradually, they can be divided into: ordinary, slep-down snowball products, etc.

2、Linked Underlying

Currently, the most common products on the market are linked to the major securities indices of various countries. The final profit or loss of investors depends on the performance of the linked index during the holding period of the product. The product can also be linked to other indices, individual stocks and stock combinations, commodities, etc.

3、Product Period

Determines the length of time that investors' funds are locked in the Snowball product. If a knock-out event is triggered, the product will end early.

4、Product coupon (annualized)

The annualized rate of return obtained by investors when a knock-out event is triggered during the product holding period, or when no knock-in or knock-out event occurs.

5、Knock-out/knock-in observation day

Compare the performance of the underlying asset with the time of the knock-out and knock-in prices. For example, the knock-out observation day is observed once a month on T-day, and the knock-in observation day is every trading day during the term.

6、Knock-out/knock-in price

The price agreed upon by investors and our platform directly affects the probability of investors obtaining the agreed returns.

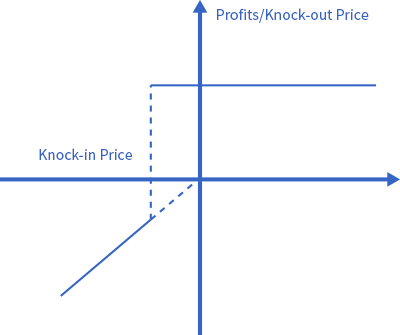

7、Knock-out/knock-in events

On the knock-out observation day, if the price of the underlying asset is higher than the knock-out price, a knock-out event is triggered, the product ends, and investors receive a profit. On the knock-in observation day, if the price of the underlying asset is lower than the knock-in price, a knock-in event is triggered, and the product will be held until the expiration date.

What are the profit and loss situations of Snowball products?

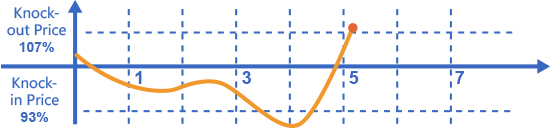

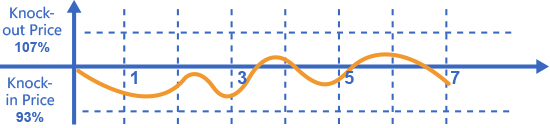

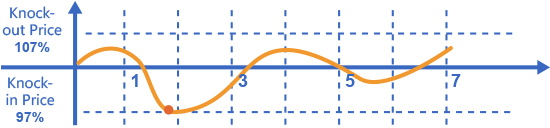

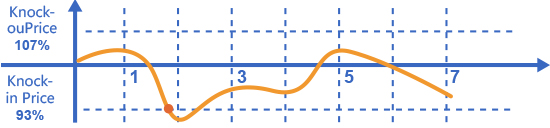

In order to let everyone understand the profit and loss of Snowball, the following takes the S&P 500 index as the linked index, with an yield to maturity of 7%, a knock-in point of 93%, a knock-out point of 107%, and a 7-days S&P 500 index Snowball product as an example to analyze several profit and loss situations of Snowball products.

Scenario 1: A knock-out event occurs

Regardless of whether it falls below the knock-in price during the holding period, if on any single holding day, the closing price of the underlying is higher than the knock-out price, the product will be terminated early and the customer will receive the knock-out profit: 7% • (5/7) =5%

Scenario 2: Neither the knock-in event nor the knock-out event occurs

During the duration, the underlying asset has not fallen to the knock-in price on any single holding day, and has not been knocked out on all holding days; when the product expires, the customer will receive an yield to maturity of 7%.

Scenario 3: A knock-in event occurs, but no knock-out event occurs

During the duration, the underlying asset has fallen to the knock-in price on any single holding day, but has not been knocked out on the remaining holding days.

First Situation:

Initial price < Expiration price < knock-out price,Revenue = 0

Second Situation:

Underlying expiry price < Initial price, loss =Actual decline of the underlying price at maturity based on the initial price

At present, the Snowball products purchased by individual investors in the market are usually in full margin mode, without leverage and without margin calls. Under the 100% margin mode, when the Snowball product is in operation, no matter how the underlying price fluctuates, investors will not face the risk of "explosion", because the maximum theoretical loss of the Snowball product is the drop of the underlying price to 0, so the theoretical maximum loss is 100% of the margin, and the actual loss is consistent with the drop of the underlying price.

What are the main risks that investors face when purchasing Snowball products?

There are several risks that you may face when investing in Snowball products:

1、Risk of falling price of the underlying asset

This is the biggest risk that investors need to face. If the price of the linked target falls by a large margin, triggering a knock-in event, and there is no subsequent rise, and the closing price of the linked target is lower than the initial price, then investors will bear the loss.

2、Risk of product unfamiliarity

Investors should take the time to fully understand how the coupons of Snowball products are calculated, understand the underlying assets to which Snowball products are linked, and fully understand the losses that may occur when Snowball products generate negative returns and the post-loss handling options.

3、Payment structure risk

Snowball products have a complex payment structure, and it is difficult for investors to accurately assess their value, risk and growth potential. For example, different maximum returns and knock-in prices will affect the payment of Snowball product coupons. Investors should fully read the product manual to understand how the coupons are calculated and paid.

4、Liquidity risk

Snowball products are financial products without active redemption clauses. The products will not terminate automatically unless a knock-out occurs, and redemption is generally not open. Investors who want to actively redeem and exit midway are not allowed to do so. They need to strictly follow the terms of the Snowball products and hold them until maturity or when they are terminated by a knock-out. Investors need to make funding arrangements in advance.

5、Reinvestment risk

Sometimes, the products are knocked out very quickly, and investors cannot obtain sufficient investment returns and face the risk of reinvestment.

6、Credit risk

Credit risk is the risk of default by the counterparty. Investors indirectly participate in Snowball product investment by purchasing asset management plans or private equity funds. If the counterparty fails to sign the contract on time, the asset management plan or private equity fund property may suffer losses. Overall, securities companies, as strictly regulated financial institutions, have strict risk management requirements, and the credit risk of default is extremely small.

account

account

Signal Group

Signal Group