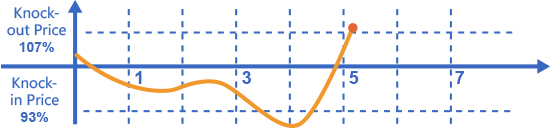

The return situation of the investor buying the desired product depends on whether the underlying market performance triggers the knock-out event and knock-in event. Investors may have a positive return, zero return, loss of three situations. Therefore, while investors are attracted by the high coupon of snowball products, they should clearly understand the profit and loss situation they may face after purchasing snowball.

Positive return

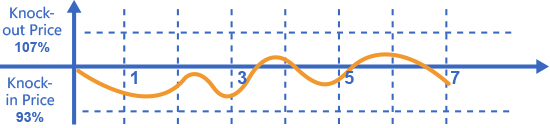

Case 1: Trigger knock-out -- knock-out profit On the knock-out observation day, if the pegged price exceeds the knock-out price, the snowball product will trigger the knock-out and profit, even if the knock-in has been triggered before.

Case 2: No knockin no knockout -- During the life of the maturity profit product, the underlying price falls or rises slightly, if the underlying price is neither lower than the knock-in price nor higher than the knock-out price, that is, the knock-in and knock-out are not triggered, and the investor gets the agreed coupon income at maturity.

Zero gain

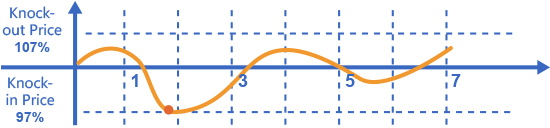

Only knock in and the underlying maturity price >= beginning price During the life of the product, no knock-out event is triggered, but the knock-in event has been triggered, and the underlying maturity price >= the initial price, then the investor gets the principal back and the total return is zero.

loss

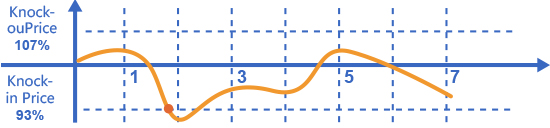

If the knock-out event is not triggered during the duration of the product, but the knock-in event has been triggered, and the underlying maturity price is lower than the initial price, the investor shall bear the principal loss, and the amount of loss depends on the decline of the underlying at the end of the period compared with the initial price. In extreme cases, investors will face a large loss of principal.

account

account

Signal Group

Signal Group