S&P 500 Snowball 3

4.0%

Maturity Yield

1.0399

NAV per Unit( 04-02 )

Linked Index : s&p_500

Product Term : 3 days

Risk Type :

Non-Capital-Protected

Time Limit

12/30-12/31

Management Fee

1.00%

Min Amount

$10.00

Max Amount

$50000.00

Amount:

Buy Now

Historical NAV

Data for reference only

| Date | Growth Share | Daily Growth Rate | NAV per Unit | Total Net Asset Value |

|---|---|---|---|---|

| 2024-08-02 | 0.0133 | 1.30% | 1.0399 | 1.0399 |

| 2024-08-01 | 0.0133 | 1.31% | 1.0266 | 1.0266 |

| 2024-07-31 | 0.0133 | 1.33% | 1.0133 | 1.0133 |

Earnings Trend

Data for reference only

The actual return will be based on the true return at the time of product knock-out or expiration

Buying Information

| Yield to Maturity | 4.0% |

| Min Amount | $10.00 |

| Max Amount | $50000.00 |

| Purchase Date | 12-30 - 12-31 |

| Management Fee | 1.00% |

| Number of Buyers | unlimited |

Basic Information

| Product Name | S&P 500 Snowball 3 |

| Linked Index | s&p_500 |

| Product Term | 3days |

| Start Date | The date of purchase is also the initial observation date |

| Knock-In Date | Daily observations, calculations performed after market close for the index |

| Knock-Out Date | Calculation after the index closes on the 1th of each month |

| Starting Price | The closing price of the index on the purchase day is considered as the initial price |

| Knock-Out Price | 106% |

| Knock-In Price | 94% |

| Knock-Out Event | During the knock-out observation period, if the closing index gain exceeds the knock-out price, a knock-out event will be triggered |

| Knock-In Event | A Knock-in Event is triggered if the intraday closing index decline exceeds the Knock-in Price |

| Security Fund | 100% |

| Closed Period | yes |

| Term Type | Short-term Product |

Profit and Loss Risk

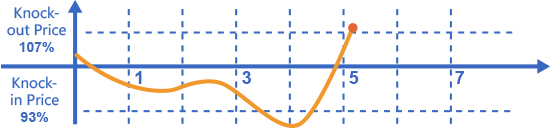

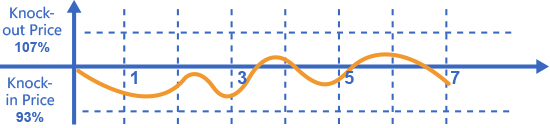

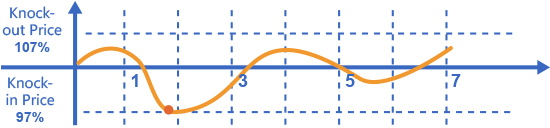

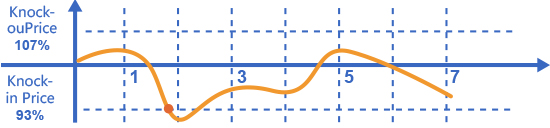

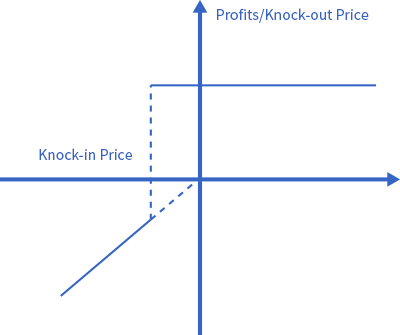

In order to let everyone understand the profit and loss of Snowball, the following takes the S&P 500 index as the linked index, with an yield to maturity of 7%, a knock-in point of 93%, a knock-out point of 107%, and a 7-days S&P 500 index Snowball product as an example to analyze several profit and loss situations of Snowball products.

Scenario 1: A knock-out event occurs

Regardless of whether it falls below the knock-in price during the holding period, if on any single holding day, the closing price of the underlying is higher than the knock-out price, the product will be terminated early and the customer will receive the knock-out profit: 7% • (5/7) =5%

Scenario 2: Neither the knock-in event nor the knock-out event occurs

During the duration, the underlying asset has not fallen to the knock-in price on any single holding day, and has not been knocked out on all holding days; when the product expires, the customer will receive an yield to maturity of 7%.

Scenario 3: A knock-in event occurs, but no knock-out event occurs

During the duration, the underlying asset has fallen to the knock-in price on any single holding day, but has not been knocked out on the remaining holding days.

First Situation:

Initial price < Expiration price < knock-out price,Revenue = 0

Second Situation:

Underlying expiry price < Initial price, loss =Actual decline of the underlying price at maturity based on the initial price

At present, the Snowball products purchased by individual investors in the market are usually in full margin mode, without leverage and without margin calls. Under the 100% margin mode, when the Snowball product is in operation, no matter how the underlying price fluctuates, investors will not face the risk of "explosion", because the maximum theoretical loss of the Snowball product is the drop of the underlying price to 0, so the theoretical maximum loss is 100% of the margin, and the actual loss is consistent with the drop of the underlying price.

Revenue Ranking List

1

USA

said****@gmail.com

$ 3056101

2

UK

Tnak****@gmail.com

$ 2830612

3

UK

aber****@gmail.com

$ 1918034

4

IN

mats****@gmail.com

$ 1637189

5

SG

hach****@gmail.com

$ 1637189

6

USA

zaka****@gmail.com

$ 1009229

7

AU

doul****@gmail.com

$ 872535

8

NG

wali****@gmail.com

$ 813779

9

IN

fift****@gmail.com

$ 690100

10

IN

isma****@gmail.com

$ 536410

focal news

Cleveland-Cliffs to buy Canadian steelmaker Stelco for $2.8 billion

1h ago

Size Credit Launch Targets Multi-Trillion-Dollar Lending Industry

23 hours ago

Global stocks drop and yen rises as volatility reigns

1 hour ago

Judge ends Giuliani bankruptcy, heightening legal risks

16h ago

Factbox-Who is speaking at the Republican National Convention?

23h ago

Wall Street gains as investors bet on second Trump term

24 minutes ago

Saudi crown prince, US national security adviser meet on Gaza, bilateral ties

7h ago

Russia says Ukraine struck Crimea with ATACMS, 60 drones shot down, oil refinery halted

2h ago

Macy's ends buyout talks on valuation worries, shares slump

1h ago

Worst fears for Slovak PM's health are over, says deputy prime minister

1h ago

account

account

Signal Group

Signal Group